Introduction

WeChat Compliance has become a cornerstone of digital engagement for ultra-high-net-worth (UHNW) and high-net-worth (HNW) clients in Singapore. Yet, as private banks harness this channel to deliver real-time portfolio insights and concierge services, they face stringent regulatory demands. In this post, we explore how Singapore’s private banks can achieve seamless WeChat compliance, elevate customer experience, and leverage FinChat’s solution to master the art of banking compliance.

Why WeChat Matters for Private Banks

- Direct Access to Affluent Clients

Over one billion monthly users—many of them affluent Asian investors—use WeChat for messaging, news, payments and lifestyle services.

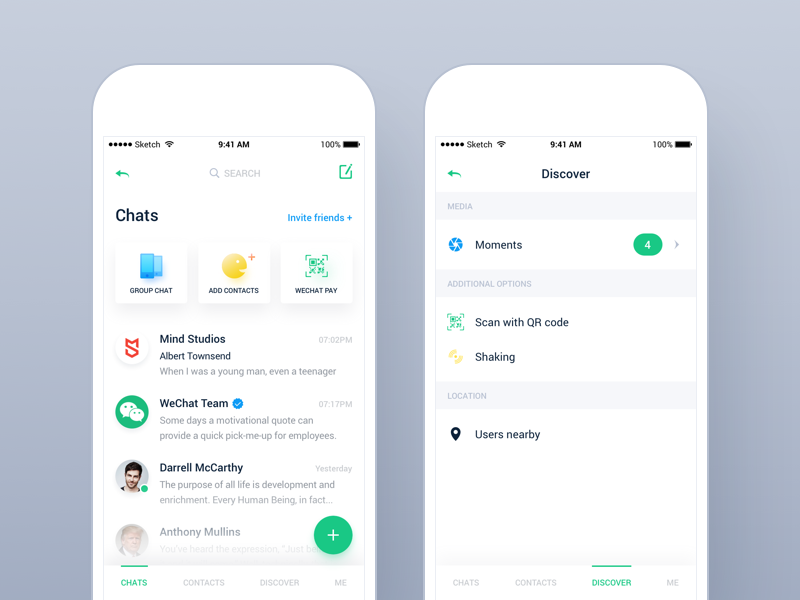

- Rich Interactive Features

From Official Accounts to mini-programs, WeChat supports voice notes, video calls and embedded financial tools to deepen engagement.

- Unified Ecosystem

WeChat Pay, in-app surveys and event invitations create a single environment for wealth updates, market commentary and VIP event management.

Regulatory Challenges on WeChat

- Data Residency & Privacy

MAS’s PDPA, EU’s GDPR and other global regulations mandate secure storage, processing and cross-border controls for chat logs and media files. - Recordkeeping & Auditing

MiFID II, FINRA and Dodd-Frank require five-year (or longer) retention of all business communications, including unstructured WeChat chats. - Content Supervision

Investment advice, product promotions or market commentary must pass pre-approval workflows to avoid MAR and Dodd-Frank breaches. - Integration Risk

Linking WeChat to CRM, OMS and analytics platforms heightens compliance complexity—each API or data feed must adhere to encryption and access-control policies.

Balancing Experience with Compliance

Treating compliance as a barrier to digital innovation is a false choice. Instead, an integrated approach can :

- Build Trust : Clients expect secure, auditable conversations, reinforcing confidence in their private bank.

- Drive Efficiency: Automated workflows free relationship managers from manual checks, accelerating communication.

- Scale Personalization: Secure APIs and structured data flows let banks tailor content without sacrificing auditability.

How FinChat Enables WeChat Compliance

- Unified Compliance Dashboard

Real-time monitoring of message volumes, flagged content and client interactions in one pane of glass. - AI-Driven Content Filtering

Automatic keyword scanning for regulated terms (e.g. “recommendation,” “guarantee”), triggering built-in approval workflows. - End-to-End Encryption & Data Residency

TLS and AES-256 encryption ensure chats and attachments are protected in transit and at rest, with storage options in Singapore, the EU or the US. - Seamless CRM & BI Integrations

Bi-directional syncing enriches customer profiles with conversation context and engagement metrics—fueling analytics and campaign optimization.

Best Practices for Private Banks

- Policy Definition : Clearly define what constitutes “business-related” WeChat communications.

- Staff Training : Educate relationship managers on how FinChat flags and processes messages to avoid delays.

- Role-Based Access: Restrict record access and deletion rights to authorized compliance officers.

- Continuous Improvement : Use analytics to track approval times, flag rates and client feedback to refine both compliance and service quality.

Conclusion

Singapore’s private banks no longer need to choose between an engaging WeChat experience and robust banking compliance. FinChat.tech’s unified platform empowers them to exceed client expectations on WeChat—while fully satisfying MAS, PDPA, GDPR and MiFID II requirements.

eady to transform your WeChat engagement? Visit FinChat.tech to schedule a demo and discover how WeChat compliance, FinChat and banking compliance can become your competitive advantage.