Introduction: The Compliance Challenge in Messaging Apps

In an era where instant messaging apps like WhatsApp dominate client communication, private banks face a critical dilemma: balancing convenience with compliance. Regulatory bodies demand strict oversight of financial conversations, yet clients crave seamless, real-time interactions. Enter Finchat, a Singapore-based tech pioneer that has redefined compliance for private banks using WhatsApp, WeChat, and Viber. This blog explores how Finchat’s tailored solutions address regulatory complexities while empowering banks to harness the power of messaging apps securely.

Why WhatsApp Compliance is Non-Negotiable for Private Banks

Private banks handle sensitive client data, making compliance with global regulations like GDPR, MAS 610, and SEC Rule 17a-4 non-negotiable. WhatsApp, while popular, poses unique risks:

- Unauthorized Communication : Advisors might use personal devices, bypassing monitored channels.

- Data Leaks : Unencrypted messages risk exposing financial details.

- Audit Gaps : Lack of message archiving violates record-keeping mandates.

A 2023 Deloitte report revealed that 68% of financial firms faced penalties for non-compliant messaging app use, underscoring the urgency for robust solutions.

Finchat’s Custom Compliance Framework for WhatsApp

Finchat’s platform is engineered to transform WhatsApp into a secure, compliant channel for private banks. Key features include:

End-to-End Encryption with Audit Trails

- All client-advisor chats are encrypted, yet accessible for audits via Finchat’s centralized dashboard.

- Real-time monitoring flags suspicious keywords (e.g., “insider trading,” “offshore account”).

Automated Archiving

- Messages, files, and voice notes are stored in tamper-proof, regulatory-compliant formats (e.g., XML, PDF).

- Integration with legacy systems like Salesforce and Temenos ensures seamless data retrieval.

Role-Based Access Controls

- Admins restrict access to authorized personnel, preventing unauthorized data sharing.

- Geolocation tagging tracks cross-border communications for jurisdictional compliance.

AI-Powered Surveillance

- Machine learning detects patterns of misconduct (e.g., unauthorized portfolio discussions).

- Sentiment analysis identifies high-risk client frustration or coercion.

Challenges in WhatsApp Compliance & Finchat’s Solutions

Finchat’s journey to becoming a compliance leader wasn’t without hurdles. Here’s how they tackled key challenges:

Adapting to Global Regulatory Fragmentation

- Challenge : Regulations vary across regions (e.g., EU’s GDPR vs. Singapore’s MAS 610).

- Solution : Finchat built a modular platform, allowing banks to toggle region-specific compliance rules. For example, EU clients auto-enable GDPR-compliant data anonymization.

Balancing Security with User Experience

- Challenge : Cumbersome tools deterred advisor adoption.

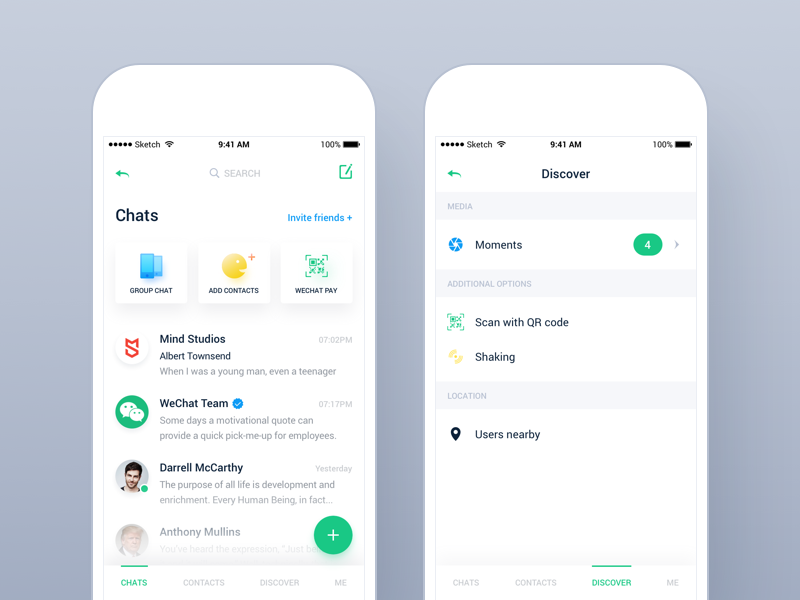

- Solution : Finchat’s Compliance interface mirrors the native app, ensuring familiarity. Advisors can’t disable compliance features, maintaining security without sacrificing ease of use

Real-Time Monitoring at Scale

- Challenge : Scanning millions of daily messages for risks.

- Solution : Partnering with AWS, Finchat deployed AI models that process data 10x faster than competitors, reducing false positives by 40%

Client Education

- Challenge : Banks resisted transitioning from email to WhatsApp.

- Solution : Finchat launched training webinars and a 24/7 support hub, emphasizing compliance benefits. A tiered rollout minimized disruption.

Why Finchat Outperforms Competitors?

The Road Ahead: Finchat’s Vision for Compliance

Finchat continues to innovate, with upcoming features like:

- Multilingual AI Moderators : Auto-translate and monitor messages in 20+ languages.

- Predictive Compliance : AI forecasts emerging risks using historical data.

- Blockchain-Based Audits : Immutable logs for regulatory submissions.

Conclusion : Finchat – The Standard for Private Banks

For private banks, non-compliance isn’t just a fine—it’s a reputational catastrophe. Finchat’s WhatsApp solution bridges the gap between regulatory rigor and client convenience, offering a future-proof framework trusted by institutions worldwide. By turning compliance into a competitive edge, Finchat empowers banks to embrace messaging apps without fear.